On March 19th, 2025, the Honourable Jim Reiter released the 2025/26 Saskatchewan provincial budget, marking his first as both Deputy Premier and Minister of Finance.

As the first budget following the 2024 provincial election, the re-elected Saskatchewan Party government focused on fulfilling several campaign promises—many of which directly impact the Saskatchewan housing market and local real estate sector.

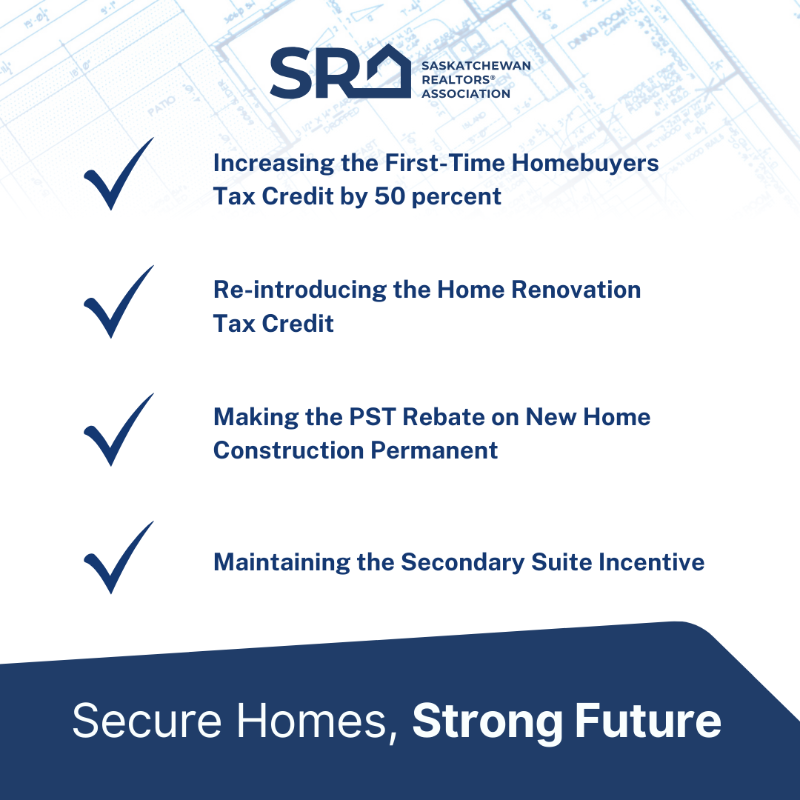

This year’s budget includes several targeted initiatives designed to support homebuyers and the broader Saskatchewan real estate market. These key measures—strongly advocated for by the SASKATCHEWAN REALTORS® ASSOCIATION through their Secure Homes, Strong Future housing policy—include:

✅ A 50% increase to the First-Time Homebuyers Tax Credit, providing valuable support for those entering the Saskatchewan real estate market.

✅ The re-introduction of the Home Renovation Tax Credit, helping homeowners invest in their properties and maintain the value of homes for sale in Saskatoon and across the province.

✅ Permanently making the PST Rebate on New Home Construction available, offering critical cost savings and encouraging new home construction in Saskatchewan.

✅ Continuing the Secondary Suite Incentive, supporting homeowners who want to add rental suites and boost available housing options.

"We’re thrilled to see the province deliver on several priorities from our housing blueprint in the 2025/26 budget. Seeing two new programs plus the renewal of initiatives that already work is great news for Saskatchewan real estate professionals and homebuyers," said SRA CEO, Chris Guérette.

"Saskatchewan’s housing market continues to experience record demand while bucking national trends. This is a pivotal time for our sector, and it’s encouraging to see the government step up to support housing in our province."

✅ Additional Budget Highlights That Impact Saskatchewan Communities:

A projected $12.2 million surplus

$8.1 billion investment in Health Care, up 6.4% from 2024/25

$3.5 billion in Education, up 3.5%

$4.6 billion for Capital Projects, supporting local infrastructure, up 4.1%

$1.1 billion toward Community Safety, up 8.9%

$1.8 billion in Social Services, up 4.4%

Small Business Tax Rate set permanently at 1%

No additional PST increases, aside from new tax on vaping products

Saskatchewan’s net debt-to-GDP ratio remains the second-lowest in Canada, signalling economic stability

These investments not only impact real estate professionals but also shape the environment for buyers, sellers, and homeowners in Saskatchewan.

Stay tuned right here on The Insider for more updated to come and what they mean for you—breaking down what it all means for the Saskatchewan housing market, local REALTORS®, and homebuyers in the coming days.

✅ Have questions about how these changes could impact your plans to buy or sell in Saskatoon?

I’d love to chat about what this means for you and your real estate goals.

👉 Contact me here for a no-obligation consultation.

Comments:

Post Your Comment: